Larry’s inclusion amount is $224, which is the sum of −$238 (Amount A) and $462 (Amount B). Treat the leasing of any aircraft by a 5% owner or related person, or the compensatory use of any aircraft, as a qualified business use if at least 25% of the total use of the aircraft during the year is for a qualified business use. If someone else uses your automobile, do not treat that use as business use unless one of the following conditions applies.

Example 1: Double-Declining Depreciation in First Period

You repair a small section on one corner of the roof of a rental house. However, if you completely replace the roof, the new roof is an improvement because it is a restoration of the building. If you improve depreciable property, you must treat the improvement as separate depreciable property. Improvement means an addition to or partial replacement of property that is a betterment to the property, restores the property, or adapts it to a new or different use. If you do not claim depreciation you are entitled to deduct, you must still reduce the basis of the property by the full amount of depreciation allowable. You must reduce the basis of property by the depreciation allowed or allowable, whichever is greater.

Declining Balance Depreciation Schedule Calculator Download

The business-use requirement generally does not apply to any listed property leased or held for leasing by anyone regularly engaged in the business of leasing listed property. Whether the use of listed property is for your employer’s convenience must be determined from all the facts. The use is for your employer’s convenience if it is for a substantial business reason of the employer. The use of listed property during your regular working hours to carry on your employer’s business is generally for the employer’s convenience. If these requirements are not met, you cannot deduct depreciation (including the section 179 deduction) or rent expenses for your use of the property as an employee. Qualified nonpersonal use vehicles are vehicles that by their nature are not likely to be used more than a minimal amount for personal purposes.

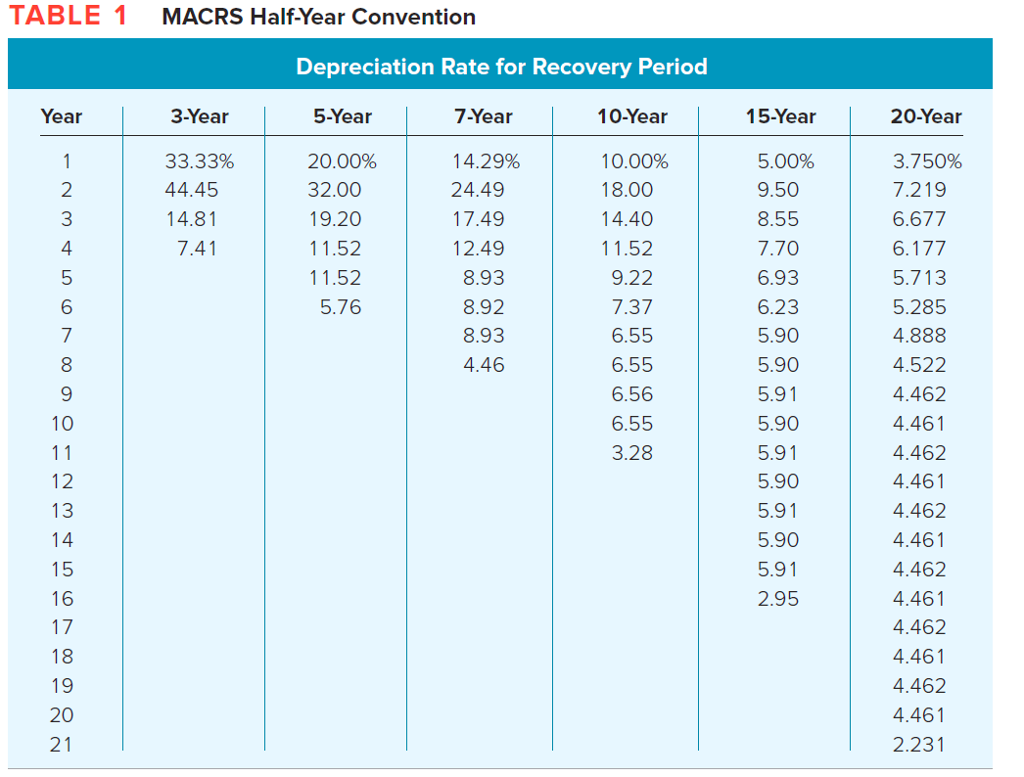

Table A-5: 3-, 5-, 7-, 10-, 15-, and 20-Year Property; Mid-Quarter Convention; Placed in Service in Fourth Quarter

However, see Like-kind exchanges and involuntary conversions, earlier, in chapter 3 under How Much Can You Deduct; and Property Acquired in a Like-kind Exchange or Involuntary Conversion next. You reduce the adjusted basis ($1,000) by the depreciation claimed in the first year ($200). Depreciation for the second year under the 200% DB method is $320. The following examples show how to figure depreciation under MACRS without using the percentage tables.

Calculating Declining Balance depreciation

The facts are the same as in the previous example, except that you elected to deduct $300,000 of the cost of section 179 property on your separate return and your spouse elected to deduct $20,000. After the due date of your returns, you and your spouse file a joint return. You 150 declining balance depreciation bought and placed in service $2,890,000 of qualified farm machinery in 2023. Your spouse has a separate business, and bought and placed in service $300,000 of qualified business equipment. This is because you and your spouse must figure the limit as if you were one taxpayer.

- For other factors besides double use the Declining Balance Method Depreciation Calculator.

- Under this convention, you treat all property placed in service or disposed of during a tax year as placed in service or disposed of at the midpoint of the year.

- The depreciation allowance for the GAA in 2024 is $3,200 [($10,000 − $2,000) × 40% (0.40)].

- John, in Example 1, allows unrelated employees to use company automobiles for personal purposes.

- It is important to understand that although the charging of depreciation affects the net income (and therefore the amount attributable to shareholders) of a business, it does not involve the movement of cash.

If you place property in service in a personal activity, you cannot claim depreciation. However, if you change the property’s use to use in a business or income-producing activity, then you can begin to depreciate it at the time of the change. You place the property in service in the business or income-producing activity on the date of the change. You begin to depreciate your property when you place it in service for use in your trade or business or for the production of income. You stop depreciating property either when you have fully recovered your cost or other basis or when you retire it from service, whichever happens first.

If you use your item of listed property 30% of the time to manage your investments and 60% of the time in your consumer research business, it is used predominantly for qualified business use. Your combined business/investment use for determining your depreciation deduction is 90%. Tara Corporation, with a short tax year beginning March 15 and ending December 31, placed in service on October 16 an item of 5-year property with a basis of $1,000. Tara does not elect to claim a section 179 deduction and the property does not qualify for a special depreciation allowance. The depreciation method for this property is the 200% declining balance method. The corporation must apply the mid-quarter convention because the property was the only item placed in service that year and it was placed in service in the last 3 months of the tax year.

In addition to being a partner in Beech Partnership, Dean is also a partner in Cedar Partnership, which allocated to Dean a $30,000 section 179 deduction and $35,000 of its taxable income from the active conduct of its business. Dean also conducts a business as a sole proprietor and, in 2023, placed in service in that business qualifying section 179 property costing $55,000. Dean had a net loss of $5,000 from that business for the year. The total amount you can elect to deduct under section 179 for most property placed in service in tax years beginning in 2023 generally cannot be more than $1,160,000.

You reduce the $1,160,000 dollar limit by the $300,000 excess of your costs over $2,890,000. In 2023, you bought and placed in service $1,160,000 in machinery and a $25,000 circular saw for your business. You elect to deduct $1,135,000 for the machinery and the entire $25,000 for the saw, a total of $1,160,000. Your $25,000 deduction for the saw completely recovered its cost. You figure this by subtracting your $1,135,000 section 179 deduction for the machinery from the $1,160,000 cost of the machinery.