You can think of an investment portfolio as a pie that has been divided into pieces of varying wedge-shaped sizes, each piece representing a different asset class and type of investment. Investors aim to construct a well-diversified portfolio to achieve a risk-return portfolio allocation that is appropriate for their level of risk tolerance. A business can have assets, too, that might include loans made, stock, cash on hand and cash in the bank, as well as accounts receivable. The business’s other assets might include real estate, office property, vehicles, inventory and even books of business (the client base).

Stocks

Financial asset values, then, can vary based on supply and demand in the marketplace where they trade. The Internal Revenue Service (IRS) requires businesses to report financial and real assets together as tangible assets for tax purposes. Understanding the advantages and disadvantages of a family income rider is essential for policyholders to make informed decisions about structuring their life insurance to best meet their family’s financial needs. A family income policy is a specialized form of life insurance designed to provide beneficiaries with a regular income stream after the policyholder’s death, mimicking the deceased’s earnings. This policy pays out in regular installments rather than a lump sum, helping beneficiaries manage daily financial needs more effectively. A family income rider enhances life insurance policies by providing beneficiaries with regular income, replacing a large sum with monthly payments.

Personal vs Business Assets

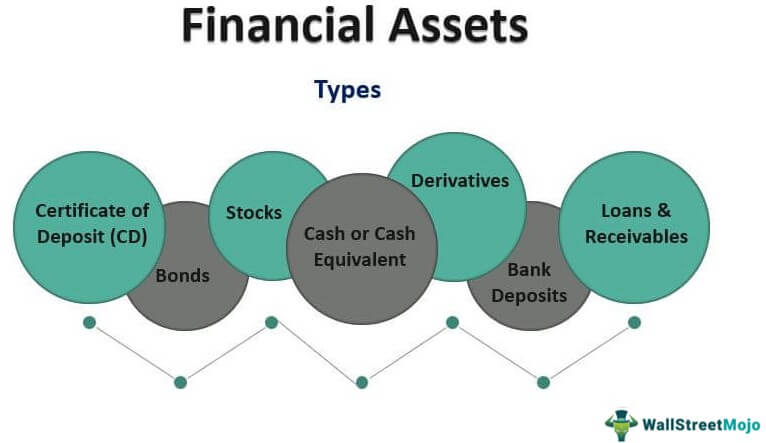

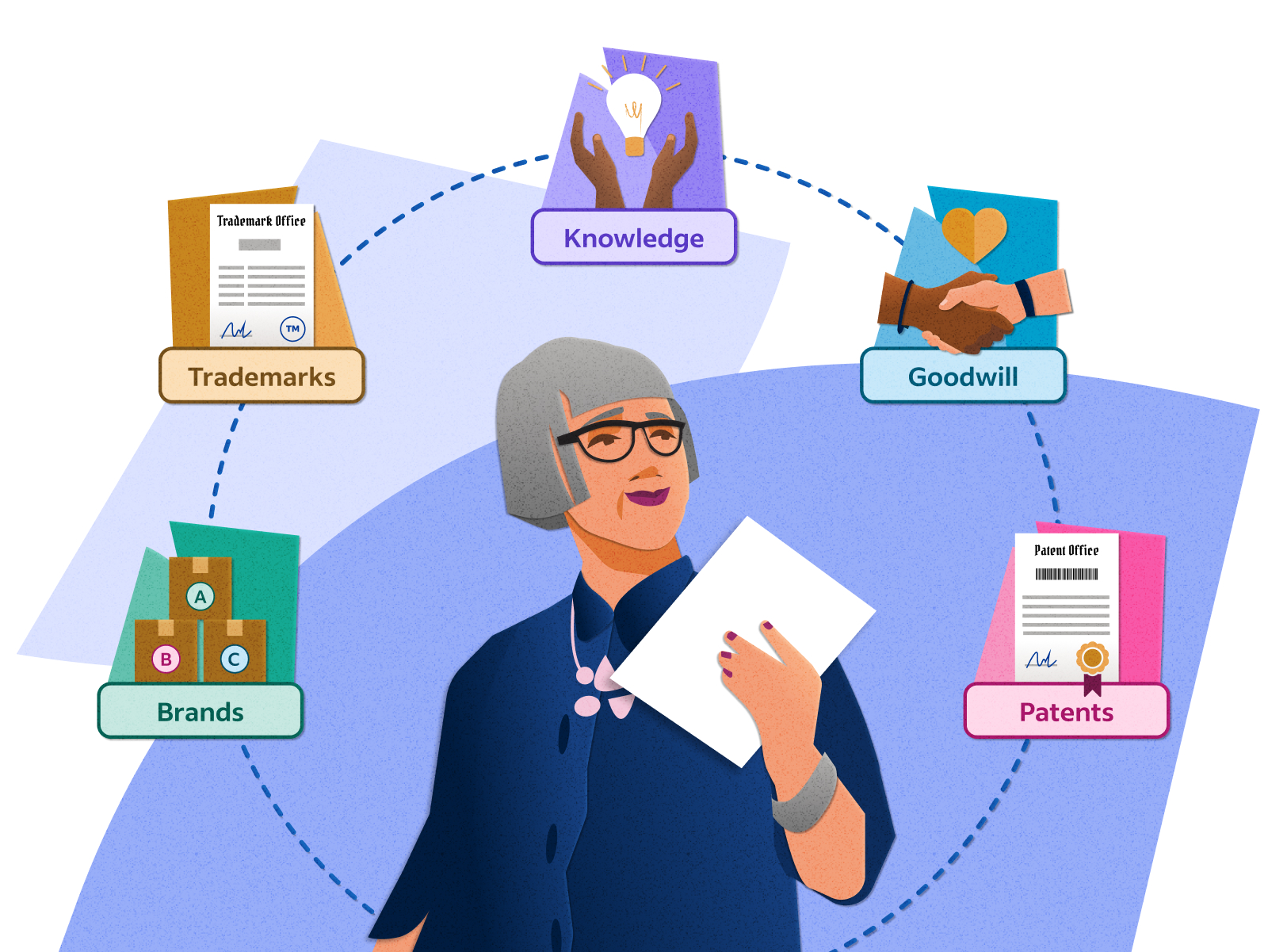

These real, often tangible assets are attached to financial assets, such as commodity futures or real estate investment trusts (REITs), respectively. Financial assets can be defined as investment assets whose value is derived from a contractual claim of what they represent. These are liquid assets as the economic resources or ownership can be converted into matter, such as cash. They are widely used to finance real estate and ownership of tangible assets. Some examples of financial instruments include stock shares, exchange-traded funds (ETFs), bonds, certificates of deposit (CDs), mutual funds, loans, and derivatives contracts. As a quick recap, short-term assets are those held for less than one year.

- Receivables is any money customers and borrowers owe to The Home Depot.

- Deciding whether a family income rider is right for you involves evaluating your personal and financial situation.

- However, in response to requests from interested parties that the accounting for financial instruments should be improved quickly, the Board divided its project to replace IAS 39 into three main phases.

- Financial assets derive their value from a contractual claim on an underlying asset.

Current Assets

This way, an investor can protect some of the profits while buying other assets when they are down in price. Fixed assets are resources with a longer term, meaning more than a year. This includes property, like buildings and other real estate, and equipment.

Cash Instruments

A family income benefit rider can be very valuable, especially for primary earners concerned about providing for their dependents’ future financial needs. It’s worth considering if you want to ensure that your family continues to receive stable financial support in your absence. The underlying assets in an aggressive portfolio generally would assume great risks in search of great returns.

For example, checking or demand deposit accounts can be used whenever you want, while CDs lock up your cash for a preset period. The above-mentioned assets are financial assets because the value is derived from the lease contract. Certain information in this Press Release, including sections entitled “Business Outlook”, may be considered as “financial outlook” within are 529 contributions tax deductible the meaning of applicable securities legislation. The purpose of this financial outlook is to provide readers with disclosure regarding Altus Group’s reasonable expectations as to the anticipated results of its proposed business activities for the periods indicated. Readers are cautioned that the financial outlook may not be appropriate for other purposes.

Most of these assets don’t have a set value until they’re liquidated and turned into cash. They come in several forms and each comes with certain advantages and disadvantages. We put together this guide to break down financial assets and what they mean. Keep reading to learn more about how financial assets work, the different types, and some of the biggest advantages.

There is no single measurement classification technique suitable for all these assets. However, they can be classified as Current Assets or Non-Current Assets on a company’s balance sheet. In early 2024, the Company initiated a global restructuring program as part of an ongoing effort to optimize its operating model. Restructuring costs were $2.0 million in the third quarter, totalling $9.1 million year to date.